PME's financial position still improving

PME sees a further increase in the funding ratio in the first quarter of this year, to 110.8%. This means the improvement in our financial position continues. This improvement is entirely due to the sharp increase in the interest rate. Over the past three months, we had a negative return of 7.9%.

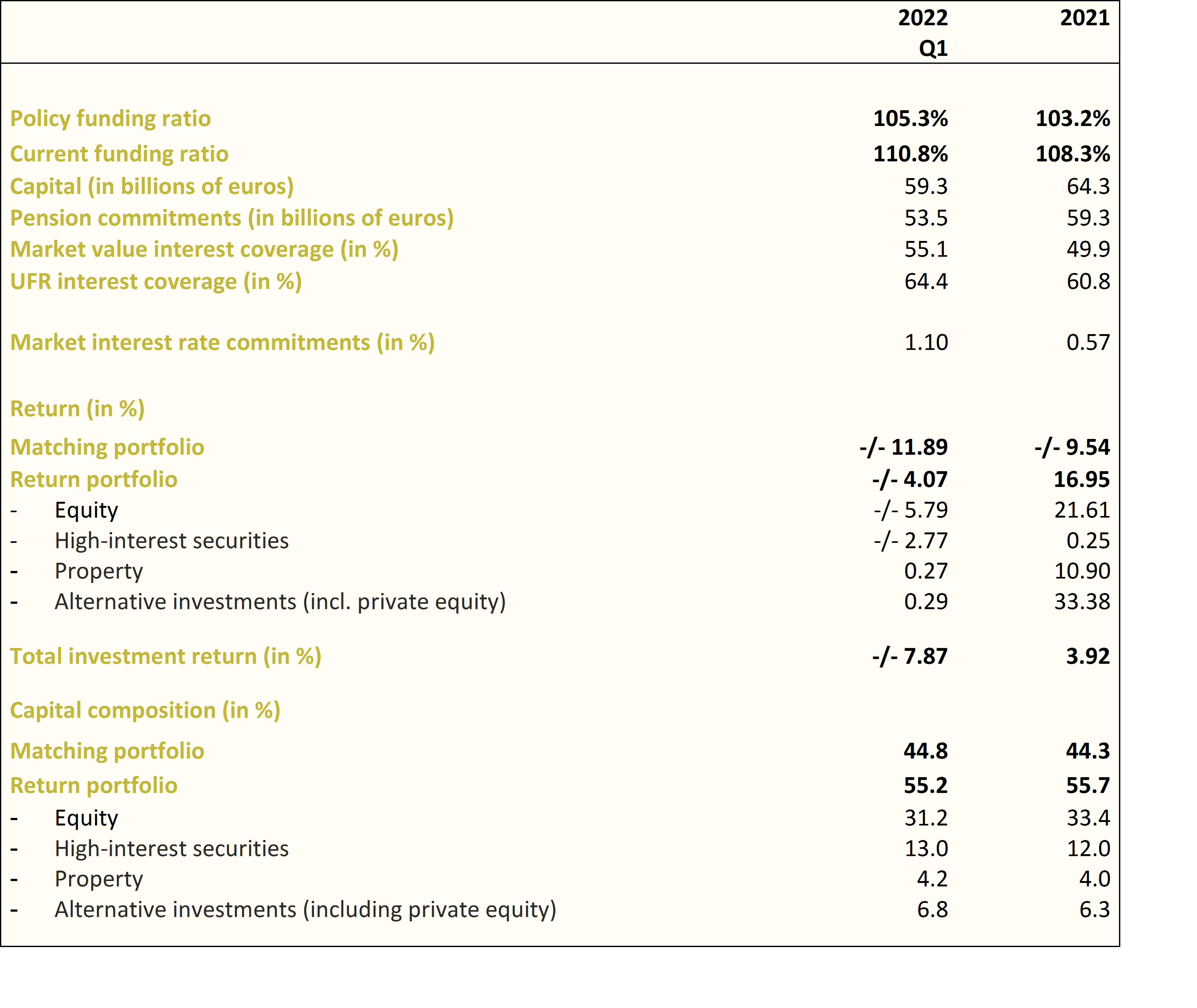

Key figures Q1 2022

- Current funding ratio as at 31 March 2022: 110.8%

- Policy funding ratio as at 31 March 2022: 105.3%

- Investment return Q1 2022: -/- 7.9%

- Capital decreased to approx. €59.3 billion in Q1

- Pension commitments decreased to approx. €53.5 billion in Q1

Eric Uijen, chairman of the executive board: "Our funding ratio improved further in the first quarter of 2022. However, the war on the fringes of Europe is causing red numbers in the financial markets. But because of the sharp rise in interest rates, PME is still doing better financially."

High inflation hurts pensioners in particular

PME pensions have not been increased in line with rising prices for years. People who are still working will be affected by this later, but pensioners are already feeling the effects. And that hurts, particularly given the recent historically high inflation rates.

Eric Uijen: "Pensions have been frozen for years and our pensioners are seeing their purchasing power decline a little more every year. This loss in purchasing power is compensated somewhat by the increase in state retirement pension. For most of our pensioners this forms the largest part of their income. But today's sky-high inflation rates makes the situation even more difficult for them. Groceries are becoming significantly more expensive and household energy bills have exploded. It's no more than logical that people are increasingly calling for indexation."

Relaxation of the rules for pension increase

The government intends to relax the rules. In the run-up to the new pension system, pension funds can already apply indexation at a policy funding ratio of 105%. PME's policy funding ratio was 105.3% at the end of March.

Eric Uijen: "We want nothing more than increase pensions, but only if we can do so responsibly. Right now this is not possible. We are exactly on the limit of where we could apply indexation if the House of Representatives ratified the new rules. Moreover, relaxation of the rules is subject to all kinds of conditions. If our recovery continues, I sincerely hope we will reach the point this year that we can apply indexation. But it must be balanced, for all generations."

Capital decreased, but commitments decreased more

PME's total capital decreased from €64.3 billion to €59.3 billion in Q1 2022. This decrease is due mainly to negative returns on investments in fixed interest securities and shares as a result of the turmoil in the financial markets caused by the war in Ukraine. That same turmoil prompted an increase in interest rates, as a result of which the value of the commitments decreased from €59.3 billion to €53.5 billion. Because commitments decreased more sharply than capital, the current funding ratio on balance increased by 2.5 percentage points in the first quarter.

Key figures Q1 2022