2024: PME on course for stability and growth

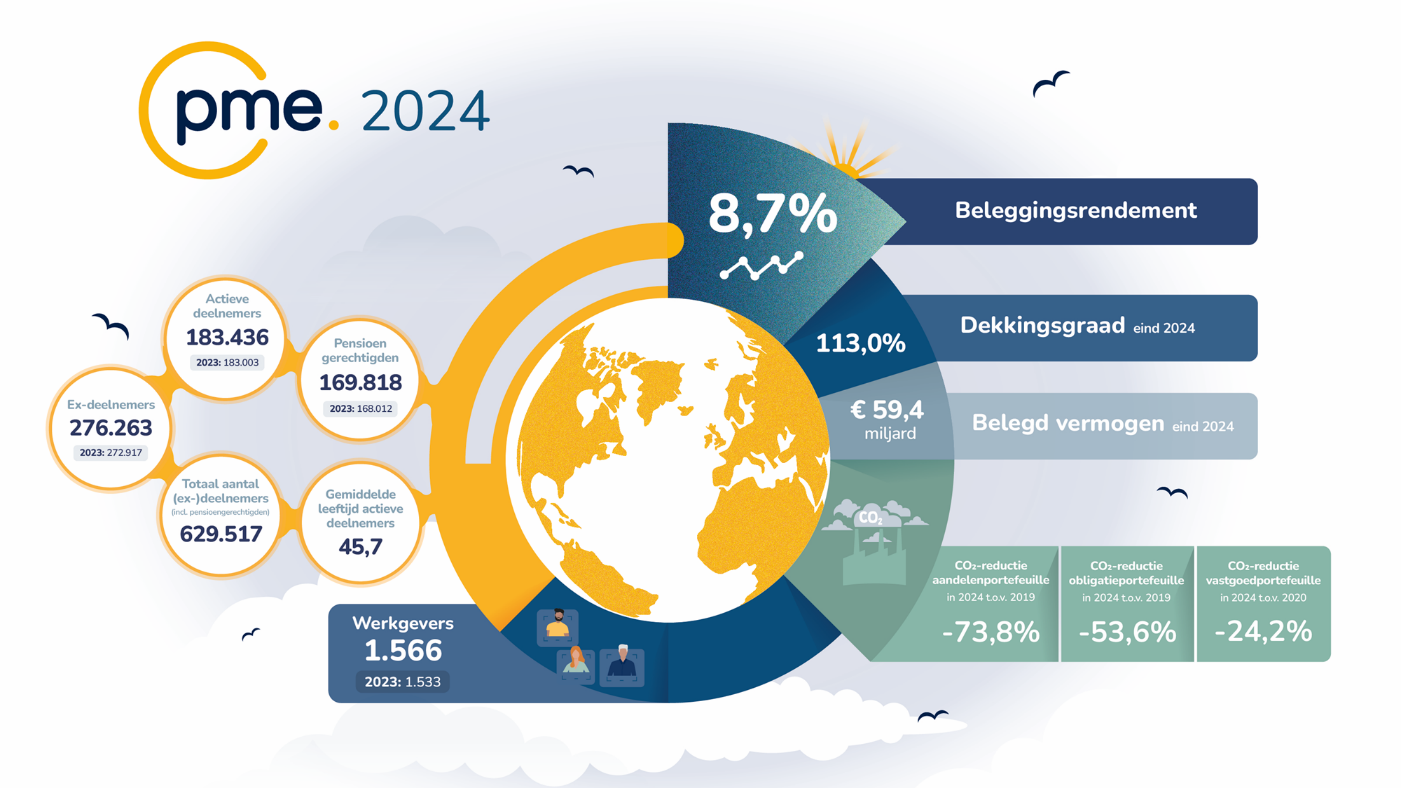

Building on a stable foundation, PME continued to grow in 2024. Assets increased by more than EUR 5 billion. A solid return on investment was achieved, at 8.7% for the full year, in line with 2023. In the run-up to the transition to the new pension rules, our organisation has temporarily expanded to ensure the quality of a well-managed and transparent process. This enables us to deliver reliable performance for our members and pensioners.

Eric Uijen, Chairman of PME's Executive Board, said: “I look back on 2024 with mixed feelings. It was a year of progress, but also one of disappointment.

PME has achieved or exceeded many of the ambitions it set out to achieve. For example, we achieved a return of 8.7%, comfortably exceeded our CO2 reduction target for the equity and corporate bond portfolios, and welcomed Honeywell as a new employer and pension fund member. We also informed our members and employers in various ways about the new pension rules and presented research showing that they and our other stakeholders are satisfied with and have confidence in PME. In 2024, pension beneficiaries gave us a satisfaction rating of 7.9 and a trust rating of 8.1. Our other stakeholders have given us a score of 7.9.

At the same time, in 2024, we decided to postpone the transition to the new pension rules by one year. As things stand, PME intends to transition on 1 January 2027. This is unfortunate, but it will ensure that we maintain the highest standards of care throughout the process. We also decided to increase pensions by a limited amount of 0.3% on 1 January 2025. That was a difficult but balanced decision. We ended the year with a funding ratio of 113%, which is a stable starting point for the turbulent first two quarters of 2025.”

Investing for a strong pension

PME has been investing for nearly 80 years to secure a strong pension for its members. In doing so, we are taking into account the costs, risks, returns and social impact of our investments. We are investing for our entry-level members as we do for our oldest member (aged 107). We do this in a diversified manner, across various categories, including equities, government and corporate bonds, infrastructure, property and private equity. We also spread our investments across the globe over a wide range of industries. PME strives to make a positive impact in this regard. These impact investments in areas such as affordable housing, our own sector and the energy transition now amount to more than EUR 3 billion of our total assets. The EUR 1.2 billion withdrawn from fossil fuels in 2021 was fully reinvested in the sustainable energy transition.

In 2024, we further increased our investments in our own sector by committing additional capital to DeeptechXL and the Strategic Partners Fund. This commitment led to additional investments in companies such as Effect Photonics, Axelera AI and Nearfield Instruments. With these investments, PME remains committed to successful Dutch start-ups and scale-ups in its own sector, our future makers.

In 2023, PME defined a new ESG framework for the selection of equities in developed countries. In 2024, this ESG framework was implemented, resulting in the sale of shares in 112 companies. Our ambition is to complete the restructuring of our developed markets portfolio by Q1 of 2026, reducing it from over 1,400 to around 1,000 companies, with a focus on around 250. For the European ESG focus portfolio, we selected Candriam as our asset manager in 2024.

Investing in the Netherlands

We firmly believe that investing in the Netherlands will generate positive social returns. This is how PME helps keep the economy healthy and boosts the country’s competitiveness. This is good for businesses and employment, and it is ultimately good for our affiliated employers and members. Naturally, striking the right balance between risk, return, costs and sustainability remains paramount when investing in the Netherlands.

The table below shows our investments in the Netherlands. By the end of 2024, approximately 15% of our investment portfolio will be invested in the Netherlands.

| Investments in the Netherlands by investment category | Amounts (x EUR 1 million) 2024 | As a percentage 2024 | Amounts (x EUR 1 million 2023 |

2023 |

|---|---|---|---|---|

| Government bonds | 1.763 | 3,0% | 1.749 | 3,2% |

| Corporate bonds | 1.530 | 2,6% | 1.532 | 2,8% |

| Mortgages | 2.751 | 4,6% | 2.593 | 4,8% |

| Shares | 89 | 0,1% | 210 | 0,4% |

| Property | 1.971 | 3,3% | 1.413 | 2,6% |

| Other | 792 | 1,4% | 418 | 0,8% |

| Total for the Netherlands | 8.896 | 15,0% | 7.915 | 14,6% |

Our results for 2024

The current funding ratio at the end of the year was 113% and the policy funding ratio was 112.7%. In 2024, we achieved a return on our investments of 8.7%, which was the same as in 2023. Expressed as a percentage of the average assets invested during the year, total asset management costs remained unchanged in 2024 at 0.4%. Expressed as a cost per member, total costs for pension management rose from EUR 103 to EUR 115 in 2024. This may be explained by temporary additional investments in the run-up to the transition to the new pension scheme in 2027. The carbon footprint of our equity and corporate bond portfolios will be reduced by 73.8% and 53.6% respectively by the end of 2024 compared to 2019. The carbon footprint of our property portfolio will be reduced by 24.2% in 2024 compared to 2020, and our target for 2040 is -40%.

Marcel Andringa, Executive Director of Balance Sheet & Asset Management said: “PME achieved an annual return of 8.7% in 2024. The funding ratio of 113% gave us a solid foundation to weather the turbulent economic reality of 2025. Fortunately, PME invests for the long term and diversifies its portfolio, investing in infrastructure, government and corporate bonds and residential property, in addition to equities. This makes us more resilient to President Trump’s economic antics, meaning that pension payments are not affected at this time. In that respect, I am confident about the future.”

Looking ahead to 2025

Eric Uijen: “The world did not become any calmer in 2024 and the first half of 2025. While PME demonstrated stability and growth, geopolitical and economic unrest around the world increased rather than decreased. President Trump taking office has certainly contributed to this. His ‘America First agenda’ and erratic trade policy are causing chaos. Closer to home, thanks to successive NSC amendments, the pension industry has also been unsettled. It kept our industry and members and retirees in uncertainty for a long time. This is not good for confidence. I am therefore pleased that the House of Representatives has realized that no participant will be better off from this amendment and hope that calm will finally return. In the meantime, PME will do everything possible to inform our participants properly and in a timely manner about what the transition to the new system means for them. I am convinced that the transition will work out better for them, with a greater chance of stability and benefit growth than under the old system.

I hope that we will enter the second half of 2025 with greater economic and geopolitical stability and that important decisions with a social impact will also be taken in the Netherlands. Investing in the Netherlands also requires stable long-term government policy. This will enable PME to invest more in defence, high-tech start-ups and scale-ups, affordable rental housing and a sustainable energy transition. Whatever happens, we can promise that PME will stay on course during these turbulent times and keep looking out for the interests of all of its members and employers.”

Read our annual report: https://www.pmepensioen.nl/en/annual-reports