We’re in a stronger financial position

PME’s financial position improved further in the second quarter of 2025. The current funding ratio rose from 116.4% at the end of March to 120.1% at the end of June, mainly due to a slight increase in interest rates. During the first half of the year, the funding ratio rose by more than 7 percentage points.

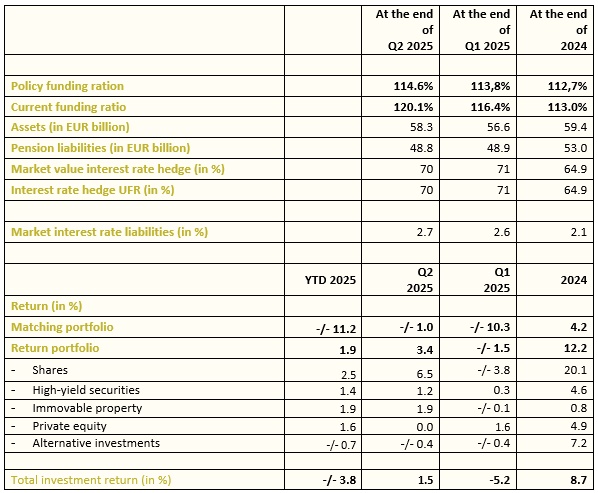

Key figures for the second quarter of 2025

- Current funding ratio as at 30 June 2025: 120.1%

- Policy funding ratio as at 30 June 2025: 114.6%

- Investment return for the second quarter of 2025: 1.5%

- Invested capital rose to approximately €58.3 billion in the second quarter of 2025

- Pension liabilities in the second quarter of 2025 decreased slightly to €48.8 billion

Eric Uijen, Chairman of the Executive Board: “The slight rise in interest rates resulted in a small negative return on our matching portfolio in the second quarter. However, because we need to set aside less money for current and future pensions as a result of rising interest rates and thanks to the positive returns on our return portfolio, our financial health improved once again. In the first half of the year, our funding ratio rose by more than 7 percentage points overall. That’s good news for our members and pensioners. Because a healthy financial position at the end of the year makes it possible to increase pensions. Plus, it will facilitate a smooth transition to the new pension scheme on 1 January 2027. Significant steps have been taken recently towards this new scheme. The Board has accepted the mandate from our social partners and has submitted our communication plan to the supervisory authorities DNB and AFM.

But we’re not there yet. We live in a turbulent world. This was also evident in the past quarter, with not only ongoing armed conflicts, but also unpredictable US trade policy causing turmoil on the financial markets. Pension funds prove their worth precisely in turbulent times. Because taking a long-term view, pursuing stable policies and sharing risks are in all of our interests. This is even more important in times of uncertainty.”

Liabilities fall more than assets

PME’s invested capital rose by 1.7 billion to €58.3 billion in the second quarter of 2025. The increase is due to the positive return on our return portfolio, which offset the negative return on the matching portfolio. The slight increase in interest rates (from 2.6% to 2.7%) also led to a decrease in pension liabilities in the second quarter. On balance, this improved the financial position and brought PME to a current funding ratio of 120.1% at the end of June 2025. At the end of 2024, it was still 113.0%.

Key figures for the second quarter of 2025