PME in a stronger financial position

PME’s financial position improved again in the third quarter of 2025. The current funding ratio rose from 120.1% at the end of June to 123.9% at the end of September, mainly due to a slight increase in the interest rate. In the first nine months of this year, the funding ratio increased by almost 11 percentage points.

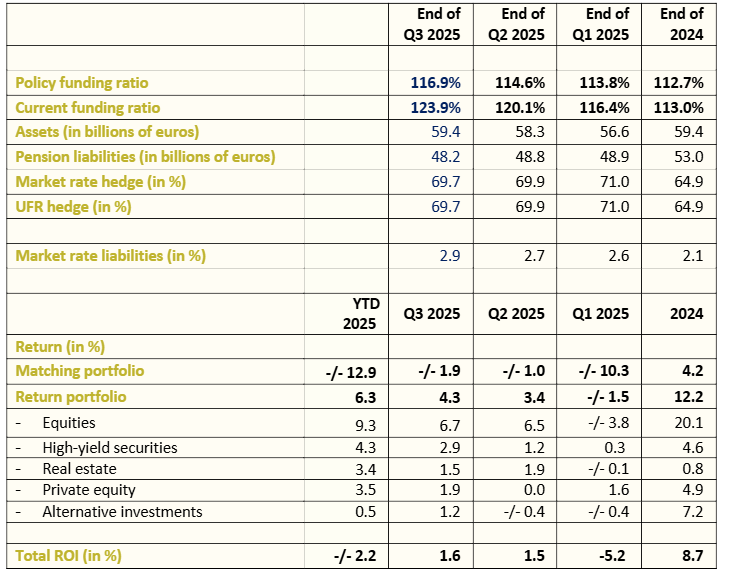

Key figures for Q3 2025

Current funding ratio as at 30 September 2025: 123.9%

Policy funding ratio as at 30 September 2025: 116.9%

Investment return in Q3 2025: 1.6%

Invested assets rose to approximately €59.4 billion in Q3 2025

Pension liabilities decreased slightly to €48.2 billion in Q3 2025

Eric Uijen, Chairman of the Executive Board: ‘In the third quarter, another slight rise in the interest rate again resulted in a negative return on our matching portfolio. But because of this rising interest rate, we have to set aside less money for current and future pensions. In addition, we posted good returns on our return portfolio in the third quarter. All in all, this improved our financial health once again. In the first three quarters of this year, our funding ratio increased by almost 11 percentage points.

If our funding ratio remains steady, it may be possible to increase pensions as of 1 January 2026. The decision we’ll need to take about this later this quarter calls for due care, as good financial health remains crucial for a smooth transition to the new pension scheme on 1 January 2027.

In the meantime, we’re working hard on the transition to the new scheme. Although we submitted an implementation and communication plan to regulators DNB and AFM this summer, the work is far from over. We’re in a constructive dialogue with DNB about our implementation plan and are also working steadily on the back end of our administration. Under the motto “Know what your future holds”, we’re informing our employers, current and former members and pension beneficiaries about the new pension rules. This quarter alone, we’ll achieve this through meetings, webinars, newsletters, our magazine, dialogue sessions and our website.’

Liabilities fall, assets rise

PME’s invested assets rose by €1.1 billion to €59.4 billion in Q3 2025. The increase is due to the positive return on our return portfolio, which was more than enough to offset the negative return on our matching portfolio. The increase in the interest rate (from 2.7% to 2.9%) also led to a further decrease in pension liabilities in Q3. On balance, this improved PME’s financial position and put the current funding ratio at 123.9% as at the end of September 2025. At the end of 2024, this was still 113.0%.

Key figures for Q3 2025