2025: A year of contrasts

The past year has been quite remarkable for PME Pension Fund. In 2025 the fund achieved an annual return of minus 3.0%. This was caused by the increase in interest rates. At the same time, the funding ratio rose from 113.1% to 125.3% due to those higher interest rates and the positive return on marketable securities. This is a strong foundation to start 2026 and amply sufficient to offset inflation and increase pensions by 2.82% on 1 January 2026. PME submitted the implementation plan for the transition to the new pension rules to DNB in 2025 and welcomed pension funds Honeywell and TDV.

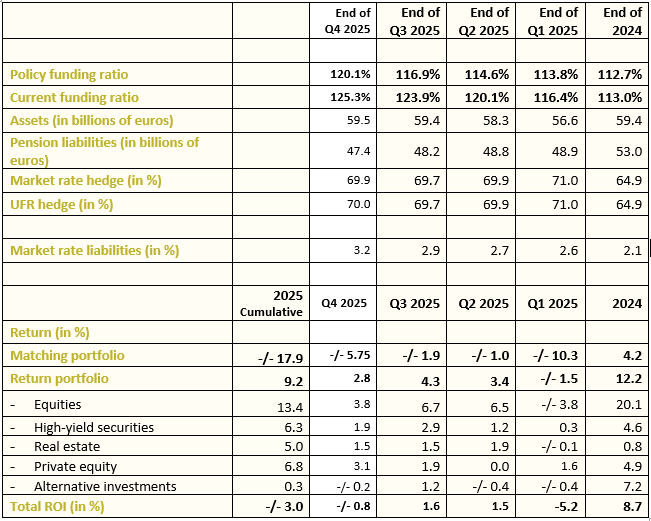

Key figures for Q4 2025

- Current funding ratio as at 31 December 2025: 125.3%

- Policy funding ratio as at 31 December 2025: 120.1%

- Investment return for Q4 2025: -/- 1.8%

- Cumulative investment return for 2025: -/- 3.0%

- Assets fell to around EUR 59.5 billion in Q4

- Pension liabilities fell to around EUR 47.4 billion in Q4

Alae Laghrich, Chairman of PME Pension Fund Executive Board:

“It has been an exceptional year in many areas. A good return on the return portfolio of over 9% was offset by a negative return on our matching portfolio due to higher interest rates. On balance, this resulted in a negative return for the entire investment portfolio. However, we did see a decrease of our liabilities. This ultimately resulted in a substantial annual increase in the funding ratio, from 113.1% to 125.3%. This allowed PME to increase pensions in line with price inflation on 1 January 2026.

It was also a busy year both nationally and internationally. In the spring of 2025, an amendment proposed by NSC and BBB caused uncertainty in the pensions sector. Fortunately, it was voted down in the House of Representatives by a narrow majority. Shortly thereafter, the Schoof cabinet fell and new elections were held. Internationally, it was an eventful year. The inauguration of President Trump has heightened economic and geopolitical uncertainty. The war in Ukraine will enter its fifth year in a few weeks' time and Gaza's future remains very uncertain. The dispute over Greenland with the United States also intensified. And threatening trade tariffs is President Trump’s means of putting pressure on countries to get his way. All in all, there is little stability.”

2026: Peace of mind for our members and employers

“However, there are positive signs. A number of large funds have transitioned to the new system on 1 January. We are also transitioning to the new pension system. I look forward to this process with confidence. On a national level, there seems to be a new dynamic on the political front with the formation of a minority cabinet. A political experiment, but with potential, aimed at shifting majorities. In addition, the challenges facing the Netherlands are clearly formulated and so are the choices that need to be made. The Draghi and Wennink reports, as well as other sources, provide direction in this regard.

Europe has now recognised that the United States is no longer the reliable ally it once was. Trade tariffs, threats and not upholding existing agreements have become commonplace. This knowledge hurts, but it clearly offers the opportunity for a closer, stronger and more independent Europe. Of course it takes time, but I believe that hard work is being done to make up for lost ground.

It also offers opportunities for us as a pension fund. The US remains an economy that cannot be ignored, where positive returns can be achieved. Nevertheless, the Netherlands and Europe have always been able to develop high-quality technology. PME has been investing in that knowledge, the ingenuity and the patents for years. And we will continue to do so, not only for the return, but also to protect those shaping the future, to keep them within Dutch and European territory and to increase economic, technological and industrial independence and resilience.

It is difficult to assess whether stability is really a thing of the past. I do know, however, that PME has provided pensions to generations for decades and will continue to do so in the future. Our strategy is long-term, we mitigate risks and take advantage of opportunities. We want and can give our employers and members support and peace of mind. In these times, this is more important than ever before. I feel that responsibility deeply and I am committed to make it happen in the years to come.”

Key figures for Q4 2025