Extra amount in your pension pot

Some people will get an extra amount in their pension pot once we switch to the new pension rules. You can read more about this below.

What is this amount?

PME wants to switch to the new pension rules on 1 January 2027. This switch is expected to be beneficial for most people. But for some people there is also a disadvantage. That disadvantage is greatest for people around the age of fifty. This is why, at the time of the switch, these people will receive an extra amount in their pension pot. This amount is also known as compensation. This will enable us to maintain their expected pension as much as possible as well.

Who gets an extra amount?

There are two important rules. You will receive an additional amount:

- If you fall under the age category 38 to 67 years at the time of the switch.

- And if you accrue pension with PME just before the switch (i.e. on 31 December 2026) and still do so immediately afterwards (i.e. on 1 January 2027).

Avoid missing out on moneyThis means that you will not receive the amount if you don't accrue a pension with PME upon the switch. Are you thinking about leaving employment or retiring before that time? Do you want to work less? Or is there a different change in your work or life? Check the questions at the end of this page and avoid missing out on money. |

What amount can I expect?

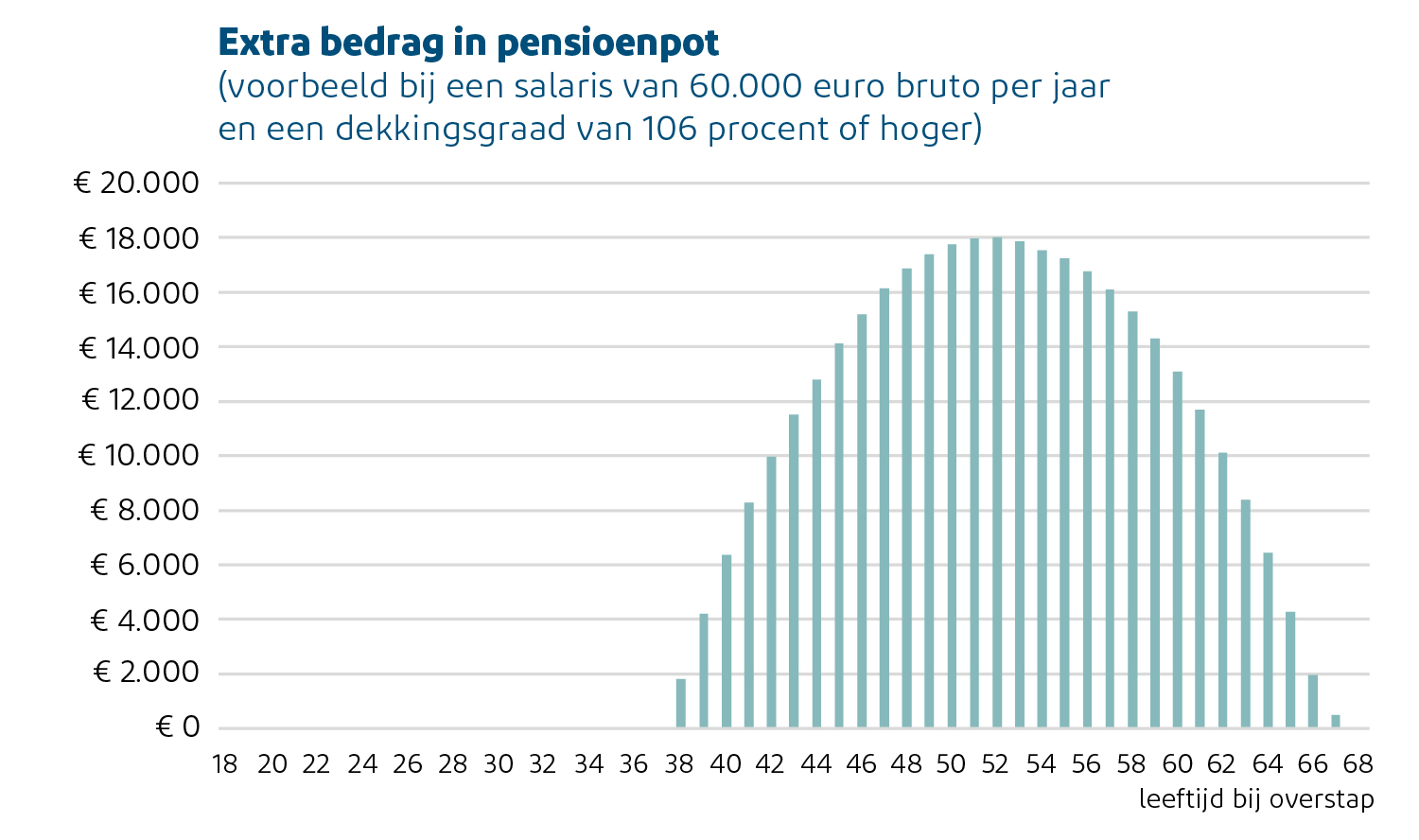

It depends on different things such as your age and your salary, but also the financial health of PME during the switch. The figure below shows the amount you can expect if you have a gross salary of € 60,000 per year and if our financial health at the switch is good enough for full compensation. You will receive this extra amount once in your pension pot. You will receive a pension from your pension pot later on for the rest of your life.

Please note: the picture is only meant to give you an idea. The actual amount depends on your own age and salary. After the switch, you will hear from us how much this amount is.

What about that financial health?

You can read this by referring to our covrage ratio. The coverage ratio indicates whether we have enough cash to pay every pension under the current rules, now and in the future. If the current coverage ratio at the switch is 106 percent or higher, we can fully compensate for the disadvantage you would have in the future. If the coverage ratio is lower, we can only do so partially. And if the coverage ratio is below 100 percent, employers and employees will start talking to each other and to us again. View our current coverage ratio.

When will I find out what this means for me?

The additional amount depends on our financial situation at the time of the switch. And, for example, your salary at that time. That is why we can only say exactly what you will receive a few months after the switch, expected in May or June 2027.

Do you want to know more before that time? For example, because you are considering leaving the sector or because you want your pension to start paying out in part or in full? We can make a cautious assessment for you from the spring of 2026. This tells you what the extra amount will mean for your expected monthly pension.

Five examples

In the examples below we use the term pensionable earnings. This is the part of your salary on which your pension accrues. You can calculate it as follows:

- Take the gross annual salary that counts towards the calculation of your pension.

- Reduce that salary by € 19,172 (amount for 2026). This threshold amount (also called the state pension offset) does not count because the state pension you will receive in the future is taken into account.

- The result is your pensionable earnings.

- Situation 1

Suppose that Casper delays his decision and is simply working 40 hours a week on 1 January 2027. For a salary of € 50,000 gross per year (and pensionable earnings of € 30,828), he will receive a one-off 15.3% of € 30,828 = € 4,716 in his pension pot. - Situation 2

Suppose that Casper will work fewer hours as from 1 November 2026: 32 hours instead of 40 hours per week (or part-time 80%). His salary at 40 hours was € 50,000 gross per year. His salary at 32 hours is € 40,000 gross per year. His pensionable earnings will then be € 24,662. He will receive a one-off 15.3% of € 24,662 = € 3,773 in his pension pot. This is 80% compared to situation 1. - Situation 3

Suppose Casper goes on four months of unpaid parental leave as from 1 November 2026. With unpaid leave, such as parental leave, he is still eligible for an additional amount. For a salary of € 50,000 gross per year (and pensionable earnings of € 30,828), he will receive a one-off 15.3% of € 30,828 = € 4,716 in his pension pot.

- Situation 1

Suppose Yasmina finds a new job outside the sector. She will start on 1 February 2027. She will therefore accrue a pension with PME just before the switch (on 31 December 2026) and just after the switch (on 1 January 2027). For a salary of € 70,000 gross per year (and pensionable earnings of € 50,828), she will receive a one-off 43.4% of € 50,828 = € 22,059 in her pension pot. - Situation 2

Suppose Yasmina finds a new job outside the sector. She will start on 1 January 2027. In this case, she will not accrue a pension with PME immediately before the switch (on 31 December 2026) and immediately after the switch (on 1 January 2027). As a result, she will not receive any extra money in her pension pot. She may, however, receive an additional amount from her new employer's pension fund or insurer. She checks this carefully. Has the pension fund or the insurer of its new employer already switched to the new rules? If so, she will not be entitled to an additional amount. - Situation 3

- Suppose Yasmina finds a new job outside the sector. She will start on 1 January 2027. In this case, she will not accrue a pension with PME immediately before the switch (on 31 December 2026) and immediately after the switch (on 1 January 2027). As a result, she will not receive any extra money in her pension pot. Her new employer turns out not to have a compulsory pension scheme. She is therefore entitled to continue to accrue pension with PME at her own expense. To this end, she must submit an application to PME on time (by 1 March 2027 at the latest). She will receive an additional one-off amount of €22,059 in her pension pot, the same amount as above.

- Situation 1

Suppose Henk leaves the sector and starts as a self-employed person on 1 February 2027. He will therefore accrue a pension with PME just before the switch (on 31 December 2026) and just after the switch (on 1 January 2027). With a gross salary of €65,000 per year (and pensionable earnings of €45,828), he will receive a one-off 31.5% of €45,828 = €14,435 in his pension pot. - Situation 2

Suppose Henk leaves the sector and starts as a self-employed person on 1 January 2027. He chooses to continue accruing pension with PME at his own expense. To this end, he must submit an application to PME in good time (no later than 1 March 2027). He will receive a one-off extra amount of €14,435 in his pension pot, the same amount as above. - Situation 3

Suppose Henk leaves the sector and starts as a self-employed person on 1 January 2027. He chooses not to continue to accrue pension with PME at his own expense. This means that he will not receive any extra money in his pension pot.

- Situation 1

Suppose Szymon works full-time and is dismissed as of 1 June 2026. From that date onwards, he receives unemployment benefits (WW). He chooses to continue accruing pension with PME at his own expense. To do so, he submits an application to PME in good time (no later than 1 March 2027). The accrual then continues at 70 percent of his normal accrual prior to the unemployment benefits. Szymon pays 50 percent of the pension contribution, and PME pays the remaining 50 percent. In this way, he accrues pension with PME just before the switch (on 31 December 2026) and just after the switch (on 1 January 2027). If he had still been employed with a gross annual salary of €65,000 (and pensionable earnings of €45,828), he would have received a one-off 41.5% of €45,828 = €19,018 in his pension pot. Because his accrual during the unemployment period is 70 percent, he receives 70 percent of that amount. He therefore receives 70% of €19,018 = €13,313 in his pension pot. - Situation 2

Suppose Szymon works full-time and is dismissed as of 1 June 2026. He chooses not to continue accruing his pension with PME at his own expense. This means that he will not receive any extra money in his pension pot.

- Situation 1

Suppose that Karin decides not to participate in the Generation Pact until 2027. With a gross salary of € 80,000 per year (and pensionable earnings of € 60,828), she will receive a one-off 24.4% of € 60,828 = € 14,842 in her pension pot. - Situation 2

Imagine Karin joining the Generation Pact before the switch. She works 80%, receives 90% salary and has 100% pension accrual. We look at her salary and part-time percentage before she started using the Generation Pact. If she already earned € 80,000 gross per year, she will receive an additional one-off amount of € 14,482 in her pension pot, the same amount as above.

- Situation 1

Suppose that Louis will retire fully on 1 December 2026 and will no longer accrue any pension with PME from that moment on. This means that he will not receive any extra money in his pension pot. - Situation 2

Suppose Louis retires fully on 1 February 2027. Upon the switch, he accrued a pension with PME. For a salary of € 65,000 gross per year (and pensionable earnings of € 45,828), he will receive a one-off 4.7% of € 45,828 is €2,153 in his pension pot.

Deepen your understanding

This is related to the contributions for your pension. You and your employer contribute money for your pension every month. The contribution of a younger employee can be invested longer. This usually yields more than the contribution of an older employee. However, young and old currently receive the same pension accrual for every euro invested. So you could say that young people are putting in too much. And in this way are contributing to the pension of older people.

This is not a problem as long as people continue to accrue pension in the same sector. Young people automatically get older and then get the benefit that older workers have. However, times have changed. These days, people are switching jobs more often, working fewer hours or are working for themselves. This is one of the reasons why the rules for pensions have changed.

With the new rules, things are different. The younger you are, the more pension you can expect for each euro contributed. That money comes into your pension pot, it no longer goes partly to the older group. This would be unfavourable for the older group: they actually put in too much when they were still young. And just when they're going to get too much for their own contribution, the rules change. This effect is strongest for people in their fifties. We want to eliminate the disadvantage that you would have in the future as much as possible. This is why these people will receive a one-off additional amount in their pension pot. This is how we are starting the new scheme as fairly as possible.

If you do not accrue a pension with PME under the new rules, you do not have the disadvantage as described in the previous question. This is a disadvantage for people who will accrue pension with us in the future. If you accrue pension elsewhere, check whether you will receive an additional amount there.

If you are moving to another company in the sector and you continue to accrue pension with PME, there is nothing wrong, you are simply eligible for an additional amount.

If you leave the sector and no longer accrue a pension with PME when you switch, you will not receive an additional amount. Take this into account and check whether you are eligible for compensation from your new pension fund or insurer. Check this carefully. If the pension fund or the insurer of your new employer has already switched to the new rules, you will not be entitled to an additional amount.

If you do not have a new pension administrator, for example because you don't have a new job, you are becoming self-employed, or because your new employer does not offer a compulsory pension scheme, you can continue to accrue pension with PME at your own expense. In that case, you will also receive an additional amount. Please ensure that your application is received by 1 March 2027 at the latest.

Have you left the sector? If you will accrue pension at your own expense with PME after making the switch, you will be eligible for an additional amount.

If you want your pension to start paying out in full, and if you no longer build up a pension with us, you will not receive an additional amount. In that case, you will no longer accrue a pension under the new rules and will therefore have no disadvantage either.

Do you want your pension to start paying out in full? And are you still accruing pension with us because you are still working and you have not yet reached state pension age? Then you are entitled to a one-off additional amount in your pension pot. For the amount, we will look at your salary and age when you make the switch.

You can have part of your pension start paying out. This is also known as part-time retirement. You will receive compensation for the part that you still work. Take into account, however, that your salary is lower if you start working less, and therefore the extra amount you can expect will also be lower.

Of course you can. Bear in mind, however, that you will only receive an extra amount if you are at most 67 years old at the time of the switch and are still accruing pension at that time. Also good to know: for people who have passed 65, the amounts are no longer very large (see the picture above). So when you make your choice, don't just be guided by the prospect of an extra amount.

You will still be eligible for an additional amount. To calculate the amount, we look at your salary and part-time percentage before you started using the Generation Pact.

If you are participating in the Generation Pact and decide to reduce your part-time percentage before the switch, the additional amount you receive will be lower.

The Generation Pact gives you the opportunity to start working less and remain healthy and fit until you retire. You will continue to fully accrue pension. Want to know more? Ask your employer or go to the website about the Generation Pact (in Dutch).

Your salary will be lower, and therefore the extra amount you can expect will also be lower. Moreover, unpaid leave does not affect the amount.

Your salary will be higher, and therefore the extra amount you can expect will also be higher.

You will still be eligible for an additional amount. Unpaid leave does not affect the amount. To calculate the amount, we will look at your salary and part-time percentage before the start of unpaid leave.

Your pension accrual will continue in part without you paying for it yourself. This means that you are entitled to an extra amount. Bear in mind, however, that your pension accrual, and therefore the additional amount, depends on the percentage that you are occupationally disabled.

If you receive unemployment benefits, sickness benefits or PAWW benefits, you can continue to accrue pension with PME at your own expense. This is done on the basis of 70% of your most recently established pensionable earnings. In this case, you will receive an additional amount calculated on the basis of that 70%. Please ensure that your application is received by 1 March 2027 at the latest.

If there is no restart or takeover, and you are no longer accruing pension with PME at the time of the switch, you will not receive an additional amount. You can choose to continue to accrue pension with PME at your own expense. In that case, you will receive an additional amount. Please ensure that your application is received by 1 March 2027 at the latest.

Are you going to divorce? That makes no difference to the amount. However, your ex-partner may receive part of your pension upon separation. If the divorce takes place after the switch, the extra amount will be part of the pension that will be distributed. Exactly what the distribution looks like depends on the arrangements you make.

We use your age in months

We'll see how old you will be on 1 January 2027. We assume that you were born on the first day of your month of birth. For example, if you were born on 21 March 1977, we do the calculation as if you were born on 1 March 1977. You will then receive the amount corresponding to the age of 49 years and 10 months.

We will use your data for December 2026

For your other details, we look at the month before the switch, i.e. from December 2026. This means your pensionable earnings (the part of your salary on which your pension accrues). This depends on:

- The gross annual salary that counts towards the calculation of your pension.

- And your part-time percentage (the number of hours you work per week compared to what your employer thinks is a full working week).

In the event of incapacity for work, the continuation percentage is decisive (the percentage of the pensionable earnings for premium-free continuation).

We look at our financial health at the time of the switch

Our financial health can be measured by our coverage ratio. The coverage ratio indicates whether we have enough cash to pay every pension, now and in the future. If the current coverage ratio at the switch is 106 percent or higher, we can fully compensate for the disadvantage you would have in the future. If the coverage ratio is lower, we can only do so partially.

The table below shows different percentages. Check your age on 1 January 2027 and look in the table at what percentage of your pensionable earnings you can expect as an additional amount.

| Age in years | Full compensation (for coverage ratio from 106%) |

| 37 and younger | 0.0% |

| 38 | 4.4% |

| 39 | 10.1% |

| 40 | 15.3% |

| 41 | 19.9% |

| 42 | 24.0% |

| 43 | 27.7% |

| 44 | 30.8% |

| 45 | 34.0% |

| 46 | 36.6% |

| 47 | 38.9% |

| 48 | 40.6% |

| 49 | 41.9% |

| 50 | 42.8% |

| 51 | 43.3% |

| 52 | 43.4% |

| 53 | 43.0% |

| 54 | 42.2% |

| 55 | 41.5% |

| 56 | 40.4% |

| 57 | 38.8% |

| 58 | 36.8% |

| 59 | 34.4% |

| 60 | 31.5% |

| 61 | 28.2% |

| 62 | 24.4% |

| 63 | 20.2% |

| 64 | 15.5% |

| 65 | 10.3% |

| 66 | 4.7% |

| 67 | 1.2% |

| 68 | 0.0% |

Notes to the above table:

- The table applies to pension accrual in the basic scheme and the high top-up scheme. Lower percentages apply to the low top-up scheme. Read more about compensation and the top-up scheme.

- In the case of a coverage ratio of between 100 and 106 percent, compensation will be partial. Read more about partial compensation.

Under the old rules, we had to have big buffers. We will distribute these in the switch on 1 January 2027. We will use part of that money for the one-off extra amount. As a result, we do have less money to increase everyone's pensions. This fits in with the careful consideration we have made. We are taking into account the interests of everyone with a pension at PME. And we are making sure that no group has a big advantage or disadvantage compared to another group.

No. The additional amount that you receive upon your switch is and will remain yours.

The employers and employees in our sector (also known as the social partners) have agreed on what the new scheme will look like, and on what this means for the accrued pensions and the pensions that are already being paid. In addition, agreements were made about the additional amount. All these agreements are laid down in the transition plan and the addendum.

Social partners and PME have chosen to provide the compensation at the switch in one go. This is clearer for everyone than if you are offering compensation over several years. As a result, in future you will not have to keep a separate pot from which you will have to pay the compensation in later years. In this way, people have the certainty that they will actually receive the compensation upon the switch. Giving compensation in one go also has a disadvantage. People who leave the sector shortly after the switch actually receive too much compensation.