Interest rate increase makes up for stock market losses

PME's funding ratio rose to 115% in Q3. This increase in the funding ratio is caused entirely by the sharp increase in the interest rate. This rose from 1.99% at the end of Q2 to 2.45% in Q3. The capital market is going through turbulent times because of global inflation and the war in Ukraine. This has resulted in a negative return of -/-4.6% over the past three months.

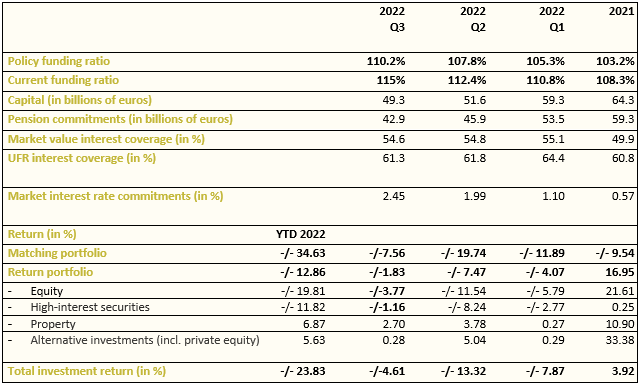

Key figures Q3 2022

- Current funding ratio as at 30 September 2022: 115%

- Policy funding ratio as at 30 September 2022: 110.2%

- Investment return Q3 2022: -/- 4.6%

- Investment return 2022 (up to and including Q3): -/- 23.8%

- Capital decreased to approx. €49.3 billion in Q3

- Pension commitments decreased to approx. €42.9 billion in Q3

Eric Uijen, chairman of the executive board: "Our funding ratio is slowly but steadily on the increase. This offers scope for indexation. Unfortunately, an increase equalling the level of inflation is not possible for PME. But I can promise that we will be able to offer more than we said in July. I believe that the current unprecedented inflation rate can only be compensated if we do this together, with the government, the employers and the pension funds. So I'm glad that state retirement pension will be increased by 10% and that a price cap for energy has been agreed for 2023. Many employers, including those in the metal and technology industries, are also taking their responsibility. At the same time, I am concerned about the allowance for energy-intensive companies; it will not always be enough for employers in our sector. They want to become more sustainable, they want to help with purchasing power compensation, but they can only do so if they survive and can compete with other countries. Unfortunately, we have not reached that stage yet."

Future of Pensions Act hopefully not postponed indefinitely

In September, the Future of Pensions Act was finally discussed in the House of Representatives. It had taken many years of careful work to get this far.

Eric Uijen: "Given the major change that the act entails, it is only logical that the House needs more time to discuss the bill. The care shown by the House is commendable, and the postponement until 1 July 2023 did not come as a surprise. But hopefully it won't be more than six months, as both the pension funds and the participants need to know where they stand. It would be a waste of all the work done in the past years. It is, in fact, a major improvement on the current system. While there won't be more money, the participants will have access to it sooner."

Capital slightly down, commitments decrease more sharply

PME's total invested capital decreased further in Q3, from €51.6 billion to €49.3 billion. This decrease is caused mainly by negative returns on the stock markets and in high-interest securities. Property made up for the loss somewhat. PME's commitments compared to the second quarter have decreased further. This has resulted in an increasing funding ratio. Due to the rise in interest rates, the value of our commitments decreased from €45.9 billion to €42.8 billion.

Marcel Andringa, executive director of balance sheet and asset management: "After years of low inflation, a low actuarial interest rate and high stock prices, the world has now hit rough waters. Central banks around the world are intervening to curb inflation, with varying success. From the United Kingdom came the unsettling news that several pension funds had to be rescued by the Bank of England. PME does not have to be afraid of this. Our investments are more diversified, the government bond market in the eurozone is varied and we have higher buffers to handle any setbacks."

Key figures Q3 2022